See Full Size

It could have been one of the biggest technology acquisitions in history

Considering Intel’s current market cap, this acquisition, if it had gone through, would have been one of the largest technology deals in history. It would also eclipse Broadcom’s massive $61 billion deal to acquire VMWare in 2023. However, such a merger would come with not only financial obligations but also global with intense antitrust scrutiny He would bring it with him.

Intel’s approx. $50 billion in debt and loss-making semiconductor manufacturing unitis among the important factors that make it difficult for Qualcomm to handle this huge operation. Qualcomm’s lack of experience in semiconductor production is also considered an additional risk factor.

See Full Size

Qualcomm is turning to new markets, including personal computers, networking and automotive chips, to generate $22 billion in additional annual revenue by fiscal 2029. Qualcomm’s CEO Cristiano Amon said in an interview with Bloomberg last week: “Currently, there is no major acquisition required for us to realize this $22 billion figure.” he said.

Intel’s restructuring challenge

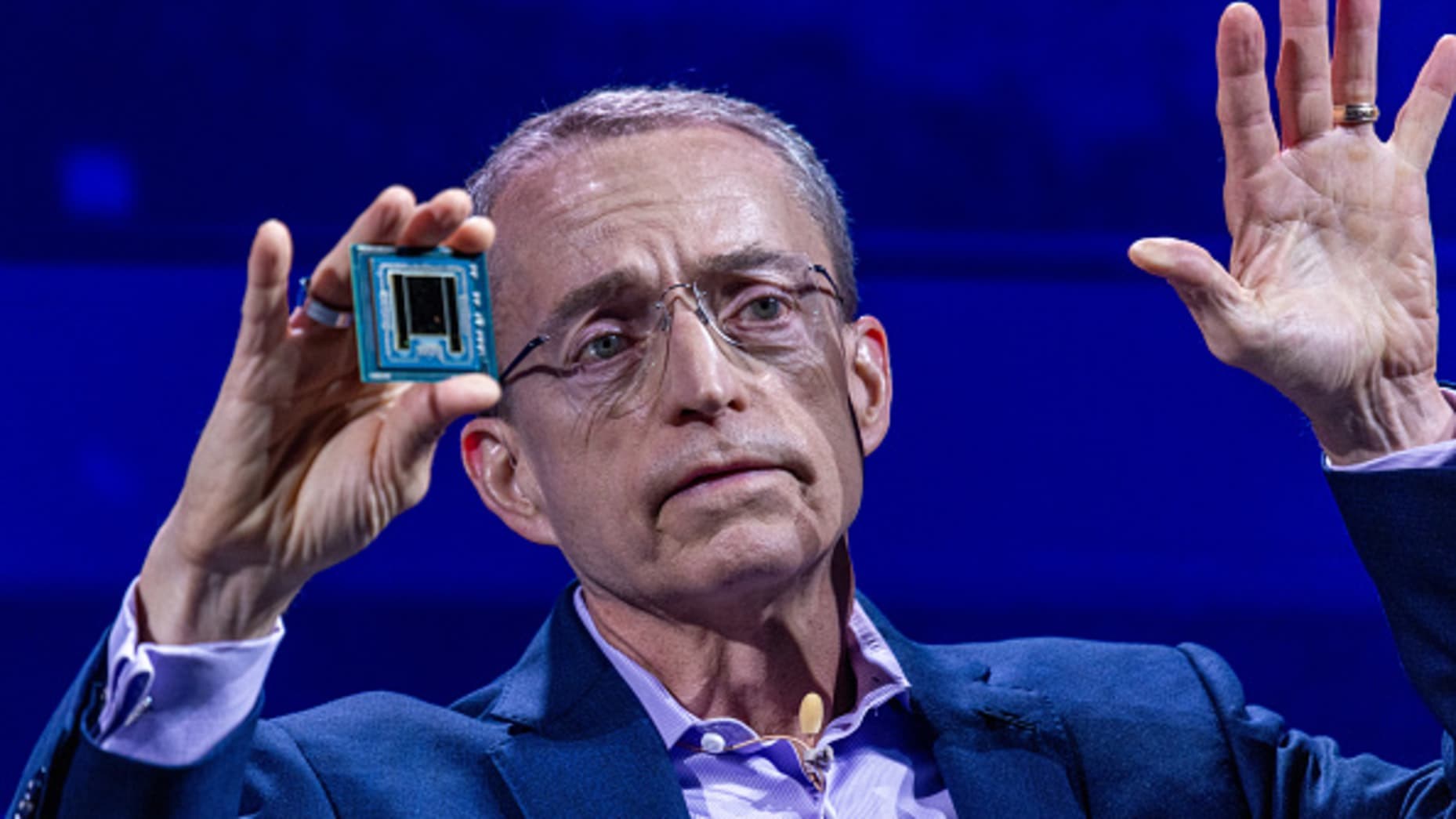

On the Intel front, CEO Pat Gelsinger stated that they focused on restructuring while preserving the current structure of the company. The market value of Intel, which will lay off 15 percent of its workforce as part of the restructuring, is at the level of 107 billion dollars. The company’s share value has fallen by almost 50 percent since the beginning of the year.

Intel continues to negotiate with potential investors for its programmable chip unit Altera as part of its restructuring. In this process, while companies such as Lattice Semiconductor have shown interest in purchasing the entire unit, it is stated that some private equity companies are also interested in minority shares.

This news our mobile application Download using

You can read it whenever you want (even offline):