See Full Size

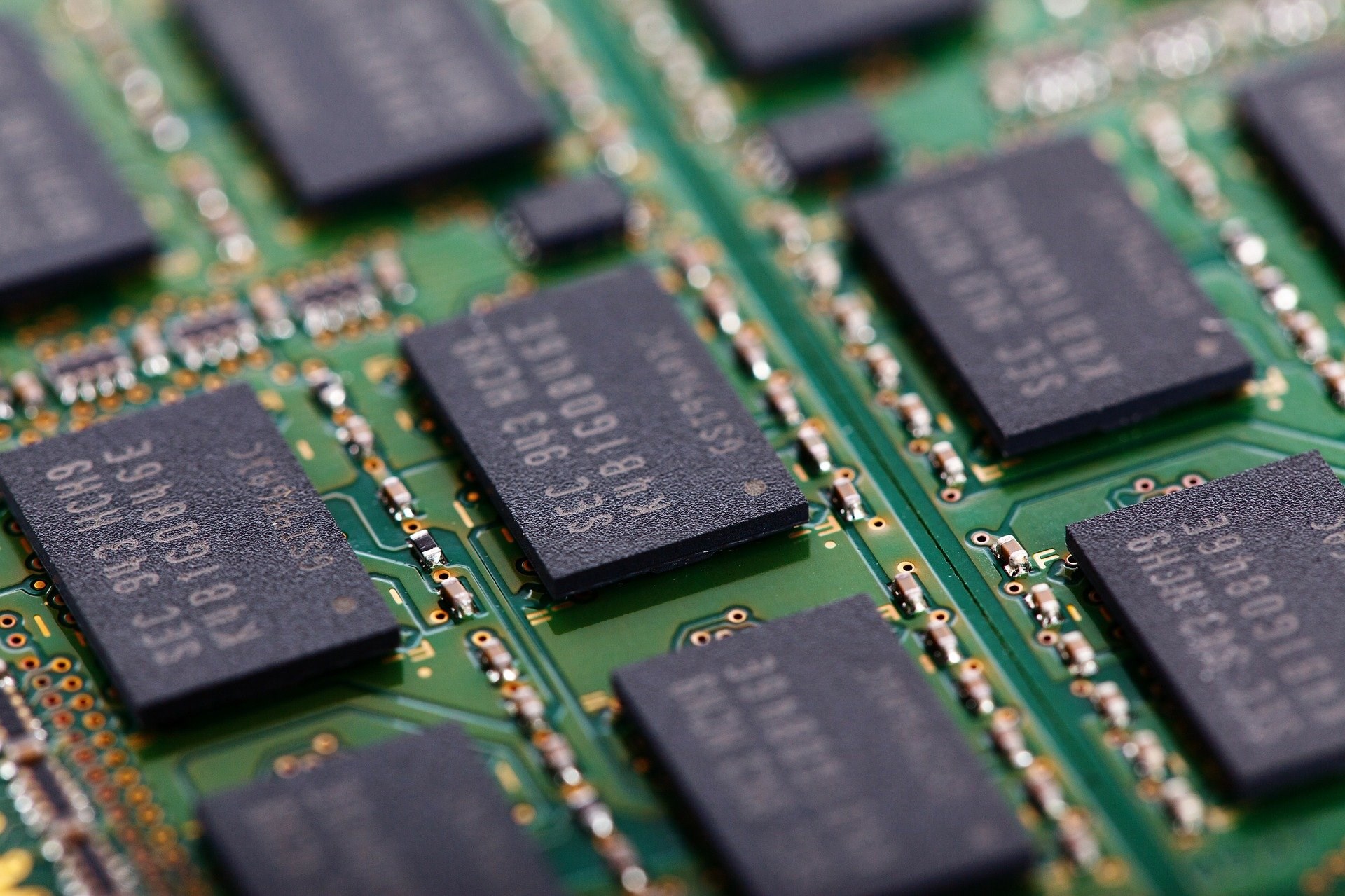

CXMT’s growth is impressive

If this prediction comes true, CXMTThe rise of may have a profound impact on the global DRAM market. Approximately three years agoCXMT’s presence in the global DRAM market share 2 percentIt was below . However, the increase in the company’s DDR4, LPDDR4 and LPDDR5 production capacity increased this rate. 10 percent in 2024 can raise the level. Gou Jiazhang said that as CXMT increased DDR5 production, 2025 towards the end can reach 15 percent he stated. Interestingly, CXMT does not appear in the reports of market tracker TrendForce.

According to media reports, CXMT’s production capacity increased from 70,000 wafer operations per month in 2022 to 120,000 in 2023 and 200,000 in 2024. Considering that the efficiency rates are at a reasonable level, the increase in CXMT’s market share is occurring at a remarkable pace.

See Full Size

CXMT currently dominates approximately 20 percent of the global smartphone market. Xiaomi ve Transsion It reportedly has some lucrative supply contracts with. Also Chinese DRAM to PC manufacturers It also supplies . However, the real profitable part of the market is On the corporate side, the company has limited influence. CXMT may need to prove something, as the corporate side tends to work with more reliable manufacturers. The DRAM market has been avoiding aggressive price wars for a long time, but with the strong entry of a fourth player, prices may decline.

This news our mobile application Download using

You can read it whenever you want (even offline):