See Full Size

Solution is difficult in the short term

While China has become a global giant, especially in electric vehicles, this has also increased the demand for automotive chips. Although China is implementing its plan to become “self-sufficient” in almost every field, the deficit in automotive chips is very serious. According to what is reported, the country’s needs in this field more than 90 percent It is met by importing.

According to officials, the low rate of automotive chips is just the tip of the iceberg. For control and calculation The rate of domestic production in chips 1 percentIt even falls below strength and memory In their chips, only 8 percent It is stated that . China aims to reach a 25 percent localization rate in automotive chips this year and demands this from manufacturers. However, according to experts, it is difficult to make a radical change in the short term.

Facts about domestic chip production

See Full Size

Increasing electric vehicle production and the increasing need for semiconductors both strain China’s capacity and increase the cost of semiconductors per vehicle. The fact that the chips in electric vehicles are now almost state-of-the-art products puts a strain on China. Because manufacturers in the country are trapped in mature production processes due to US restrictions.

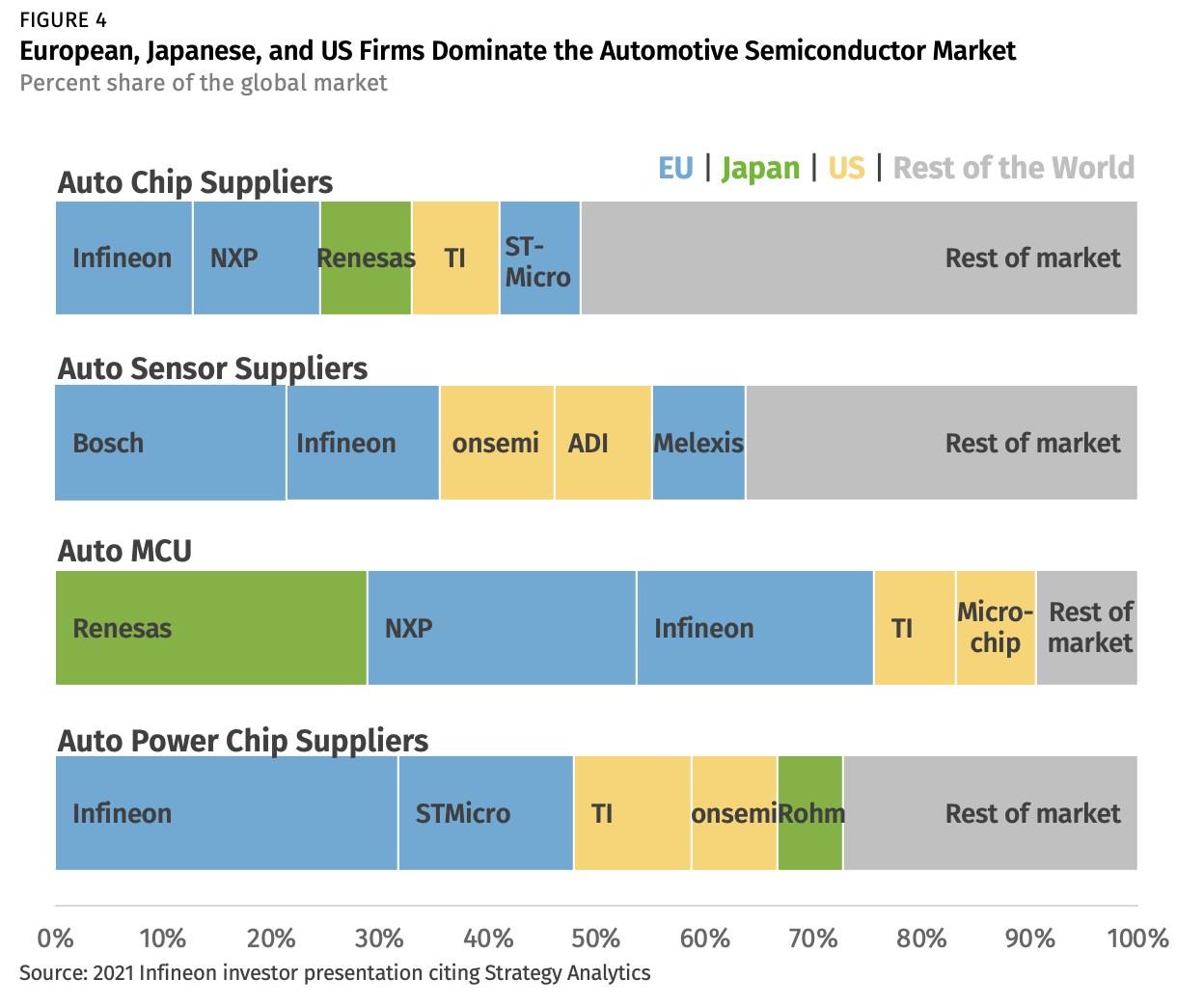

On the other hand, China’s automotive chip market is still Infineon, NXP, STMicroelectronics, Texas Instruments ve Renesas Global giants such as are dominant. Especially in high-tech segments such as smart driving controller chips Nvidia ve Tesla Players such as have the largest shares in the Chinese market. However, companies like Nio and Xpeng are stepping up efforts to develop their own smart driving chips. Both companies announced this year that they had successfully completed the design process of their chips.

This news our mobile application Download using

You can read it whenever you want (even offline):