See Full Size

What are the reasons for the decline?

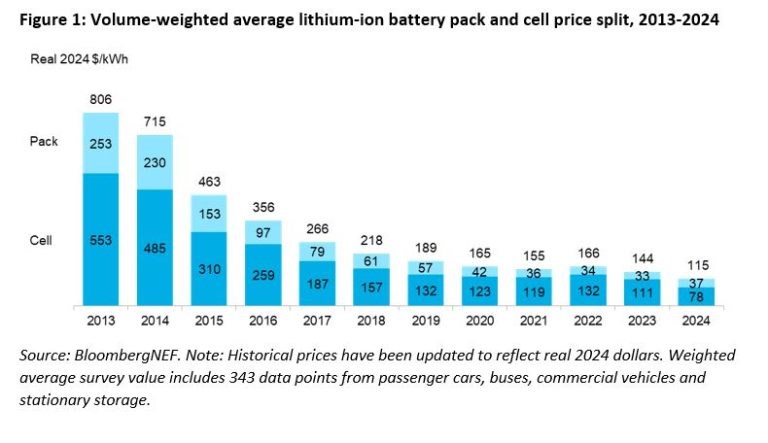

Factors driving the decline include excess cell production capacity, economies of scale, lower metal and component prices, the proliferation of lower-cost lithium iron phosphate (LFP) batteries, and a slowdown in electric vehicle sales growth.

BNEF, battery production capacity 3,1 TWhand that this capacity will exceed the annual demand for lithium-ion batteries in 2024. more than 2.5 times states that it is.

On a regional basis, average battery pack prices in China 94 dollars/kWh was realized at the lowest level. Battery prices in the USA and Europe are respectively 31% and 48% higher was detected as. BNEF attributes the reason for this situation to high production costs, as well as the relative immaturity of the markets and low volume production.

BNEF states that the price gap between China, Europe and the USA has widened this year. This shows that the price decline in China is more pronounced. It is stated that due to overproduction and falling prices, Chinese manufacturers are turning to areas such as energy storage.

Electric and internal combustion vehicle costs have become par for the course in China

Electric vehicle battery prices are specific to China falling below 100 dollars/kWh for the first timeinternal combustion vehicles and electric vehicle prices broke even.. While there is still a significant cost gap in other markets, this gap is expected to close within the next few years.

Based on its near-term outlook, BNEF expects package prices to increase in 2025. He expects it to decrease by $3/kWh. Looking ahead, further price declines are expected over the next decade thanks to R&D investments, manufacturing process improvements and capacity expansion throughout the supply chain.

Additionally, analysts expect technologies such as silicon and lithium metal anodes, solid-state electrolytes, new cathode materials, and new cell manufacturing processes to enable further price declines over the next decade.

This news our mobile application Download using

You can read it whenever you want (even offline):