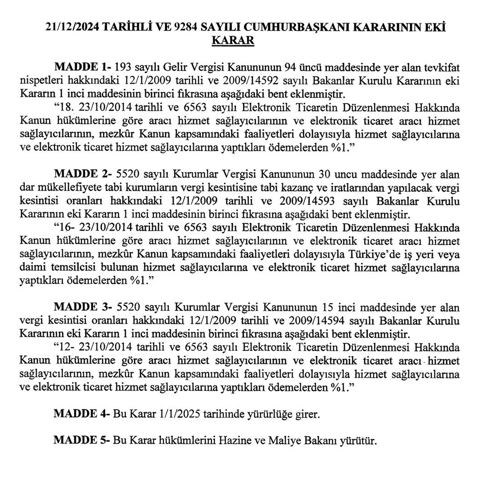

On December 21, 2024 In the Official Gazette With the Presidential Decree No. 9284 published, a significant change was implemented in the e-commerce sector. With the articles added to the Income Tax Law No. 193 and the Corporate Tax Law No. 5520, it was announced that a 1% deduction will be applied to payments made to electronic commerce service providers.

This regulation targets service providers and electronic commerce intermediary service providers within the scope of Law No. 6563 on the Regulation of Electronic Commerce. The decision is seen as a new step in the field of regulating and taxing electronic commerce activities in Turkey.

According to the decision:

- Payments made to electronic commerce intermediary service providers and service providers operating in this sector 1% deduction will be implemented.

- The application also covers service providers who have a workplace or permanent representation in Turkey.

The interruption in question As of January 1, 2025 will come into force. It is stated that with the new regulation, the state aims to tax and record the income obtained through e-commerce more effectively.

This regulation, which will be carried out by the Ministry of Treasury and Finance, in the e-commerce ecosystem Its effects are eagerly awaited.

This news our mobile application Download using

You can read it whenever you want (even offline):

12 hours ago

These seem very scary to me.